The crypto market is as unpredictable as it is exhilarating. Whether you're a seasoned investor or just stepping into this brave new world, understanding its underlying dynamics can mean the difference between striking gold and facing a hard fall. Drawing on over seven years of hands-on experience, this guide distills hard-won lessons into a clear, practical roadmap for success.

In this article, we'll cover:

- Self-Assessment & Cash Flow Mastery: Discover your investor profile.

- Decoding the Crypto Market Cycle: Learn to identify the four key phases.

- Tokenomics & FOMO Control: Become a tokenomics expert and manage your emotional investing.

- Building Your Competitive Edge: Harness the power of social media and community.

Let's dive into the insights that can transform your approach to crypto investing.

1. Know Thyself: The Foundation of Smart Investing

Before you put a single dollar into crypto, take a hard look at your financial situation and risk appetite. The first step is to understand your personal investor profile. Ask yourself:

- What are my monthly income and fixed expenses (rent, mortgage, bills)?

- How much discretionary money do I have for investing versus enjoying life?

- Am I a young professional with fewer obligations or a family-oriented investor with long-term commitments?

A simple cash flow breakdown can be a game changer:

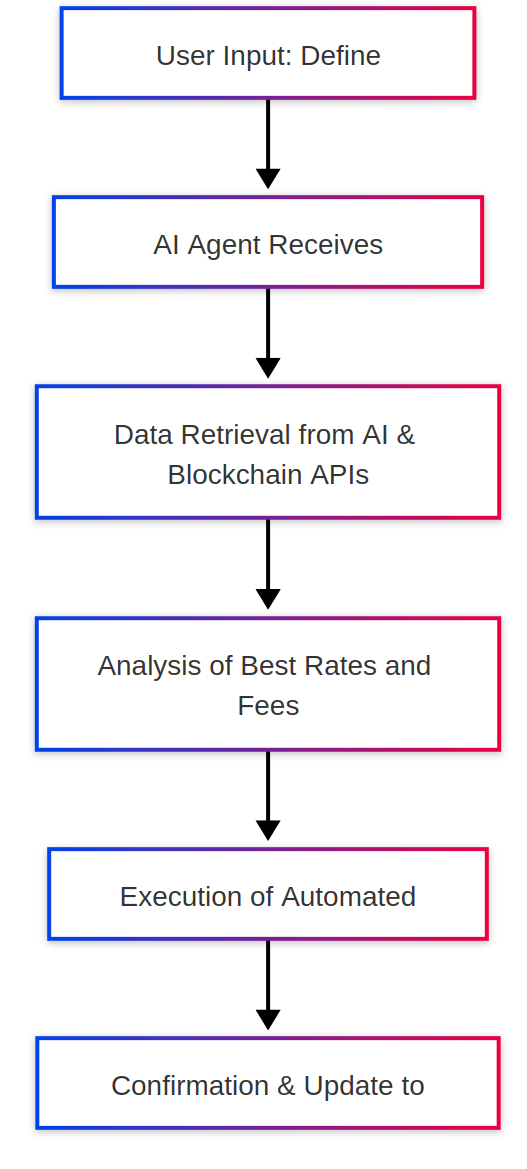

This flowchart helps you visualize the process of assessing your cash flow to decide how much capital you can comfortably risk in the crypto market.

2. The Crypto Market Cycle: From Accumulation to Markdown

Understanding the cyclical nature of the crypto market is essential. The market typically moves through four distinct phases:

- Accumulation Phase

At this stage, market sentiment is low. Prices have bottomed out, and only a few early believers are buying. This is the time when the foundations for the next bull run are being laid. - Markup Phase

As new technologies and innovations emerge — often fueled by institutional interest and positive regulatory shifts — the market experiences a surge. Expectations soar as hype builds up around major news such as ETF approvals or breakthrough partnerships. - Distribution Phase

Here, the bubble starts to deflate. Despite lingering optimism, the market shows signs of overextension. Prices reach unsustainable levels, and early investors begin to cash out. - Markdown Phase

Finally, reality sets in. Overinflated expectations come crashing down, leading to significant sell-offs. This phase paves the way for a fresh start in the next accumulation period.

To illustrate, consider this state diagram that maps the journey:

Understanding where the market stands within this cycle helps you make smarter entry and exit decisions. It also clarifies why "holding forever" isn't always the best strategy — sometimes, it's wiser to take profits as the hype peaks.

3. Mastering Tokenomics & Taming FOMO

Become a Tokenomics Expert

Tokenomics is the lifeblood of crypto investing. Every token has its own economic model — supply, distribution mechanisms, utility, and demand drivers. Many investors lose money simply because they haven't dug deep enough into these details. For example, projects that reached all-time highs only to plummet in value often did so because investors failed to understand their underlying tokenomics.

Key takeaway:

Study the structure of each token and how it influences its market behavior. Become proficient at analyzing token supply, emission schedules, and demand curves.

Control Your FOMO (Fear of Missing Out)

Crypto markets are notorious for their emotional swings. Social media buzz and sensational headlines can create a fear of missing out, leading to rash decisions. The advice here is clear: avoid buying the dip with the expectation of an endless drop. Instead, set realistic entry points and stick to a disciplined strategy — even if that means paying a bit more for quality assets when the market is hot.

4. Building Your Competitive Edge: The Power of Information

In the world of crypto, timing is everything. Gaining an edge over the competition means staying ahead of the curve by leveraging social media and specialized tools. Here are some practical tips:

- Twitter as Your Information Hub:

Instead of passively scrolling through endless feeds, use Twitter Pro's list functionality to follow key influencers, early project discoverers, and seasoned analysts. Create custom lists to filter noise and capture only the most relevant updates. - Utilize Crypto Research Tools:

Platforms like Dex Screener and DeFi Llama offer invaluable insights into token volume, liquidity, and trends. These tools help you track projects that are gaining traction before they hit mainstream awareness. - Join a Community:

Whether it's a private group like Agora or any other vibrant crypto community, surrounding yourself with informed peers is crucial. Sharing ideas and experiences not only accelerates your learning curve but also shields you from making isolated mistakes.

Invest with Confidence and Curiosity

Crypto investing is not just about chasing the next big win — it's about developing a nuanced understanding of a rapidly evolving market. By knowing your financial profile, mastering market cycles, delving deep into tokenomics, and arming yourself with timely information, you set yourself on the path to sustainable success.

What steps will you take today to refine your crypto strategy? Join the conversation — share your thoughts, questions, and experiences in the comments below. Remember, every smart investor was once a curious beginner.

source: https://raglup.medium.com/unlocking-crypto-mastery-insider-lessons-from-7-years-in-the-crypto-world-bdb7a81ea53a?source=rss-f56f44caad34------2